Latest Version

Version

1.6

1.6

Update

May 20, 2025

May 20, 2025

Developer

E-Startup India

E-Startup India

Categories

Finance

Finance

Platforms

Android

Android

Downloads

0

0

License

Free

Free

Package Name

app.instagst

app.instagst

Report

Report a Problem

Report a Problem

More About InstaGST -GST Finder & Tracker

INSTAGST is a free📱app for 🔍searching any business details by GSTIN.

You can find following⬇️business information of anyone:-

✔️GST Score

✔️GST Active / Inactive Status

✔️GST Return Filing Track Record

✔️Legal Business Name

✔️Business Address

✔️Date of Incorporation

✔️Type of Business

✔️Nature of Business

Key Features

✔️ GST Tracker app

✔️ Check your GSTIN

✔️ Get details of any GSTIN

✔️ ITC Mismatch Report app

✔️ Identify Fake GST Numbers

✔️ Know suspicious business or supplier

✔️ Get ITC Mismatch Invoice Report

✔️ Share GSTIN or ITC results with anyone

✔️ Don't need to register, get the detail instant

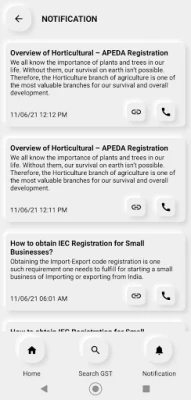

✔️ Get notifications of the GST due dates

GST Score is a unique feature of InstaGST 📱 which provides a score to any business 0-1000 based on business GST compliance performance.

If the supplier does not file🧾GST Return on time then you can suffer claiming ITC on purchase at the time of filing GST Return.

📱InstaGST will help you to decide whether to deal with Supplier or not, based on GST Score performance.

If you are looking 🔍"How to check GST return filed or not by vendor/supplier on mobile”, Then 'INSTAGST is the best app for you, 📱INSTAGST is a simple and handy GST search & ITC🔀tracking app for business owners that gives instantly anyone GST details in just one click.

📱INSTAGST app can measure GST scores & helps you in ITC reconciliation issues for medium-to-large enterprises.

ITC Mismatch Report

The best thing about the📱InstaGST app is that you don't need to register every time to check your ITC Mismatch Report.

Just register once with your OTP & you can see all your monthly ITC GSTR-2A Report and compare it with ITC claimed by you in detail.

✔️ ITC Claimed by you vs ITC given by the supplier

✔️ Get ITC Mismatch Report as per Invoice & Suppliers

✔️ Get Invoice Number & Invoice details of supplier

✔️ Check GST Score/details through Invoice Number in ITC mismatch Report Section

✔️ Supplier Invoice Mismatch

Source of Information: All the sources of the Information of the App taken from the government official website www.gst.gov.in.

INSTAGST can be used for

- Lookup for businesses, by GST Number

- Keep 🔀 track of GST Return filings done by your vendors and suppliers

- See the summarised filing view of all your vendors GSTIN

- Ensure whether vendor/supplier filling ITC or not

- Get a comparison of ITC claimed by you and ITC were given by suppliers

- Find out the complete list of suppliers who give you an input tax credit

- Get GST Due Dates Notifications

✔️GST Score

✔️GST Active / Inactive Status

✔️GST Return Filing Track Record

✔️Legal Business Name

✔️Business Address

✔️Date of Incorporation

✔️Type of Business

✔️Nature of Business

Key Features

✔️ GST Tracker app

✔️ Check your GSTIN

✔️ Get details of any GSTIN

✔️ ITC Mismatch Report app

✔️ Identify Fake GST Numbers

✔️ Know suspicious business or supplier

✔️ Get ITC Mismatch Invoice Report

✔️ Share GSTIN or ITC results with anyone

✔️ Don't need to register, get the detail instant

✔️ Get notifications of the GST due dates

GST Score is a unique feature of InstaGST 📱 which provides a score to any business 0-1000 based on business GST compliance performance.

If the supplier does not file🧾GST Return on time then you can suffer claiming ITC on purchase at the time of filing GST Return.

📱InstaGST will help you to decide whether to deal with Supplier or not, based on GST Score performance.

If you are looking 🔍"How to check GST return filed or not by vendor/supplier on mobile”, Then 'INSTAGST is the best app for you, 📱INSTAGST is a simple and handy GST search & ITC🔀tracking app for business owners that gives instantly anyone GST details in just one click.

📱INSTAGST app can measure GST scores & helps you in ITC reconciliation issues for medium-to-large enterprises.

ITC Mismatch Report

The best thing about the📱InstaGST app is that you don't need to register every time to check your ITC Mismatch Report.

Just register once with your OTP & you can see all your monthly ITC GSTR-2A Report and compare it with ITC claimed by you in detail.

✔️ ITC Claimed by you vs ITC given by the supplier

✔️ Get ITC Mismatch Report as per Invoice & Suppliers

✔️ Get Invoice Number & Invoice details of supplier

✔️ Check GST Score/details through Invoice Number in ITC mismatch Report Section

✔️ Supplier Invoice Mismatch

Source of Information: All the sources of the Information of the App taken from the government official website www.gst.gov.in.

INSTAGST can be used for

- Lookup for businesses, by GST Number

- Keep 🔀 track of GST Return filings done by your vendors and suppliers

- See the summarised filing view of all your vendors GSTIN

- Ensure whether vendor/supplier filling ITC or not

- Get a comparison of ITC claimed by you and ITC were given by suppliers

- Find out the complete list of suppliers who give you an input tax credit

- Get GST Due Dates Notifications

Rate the App

Add Comment & Review

User Reviews

Based on 0 reviews

No reviews added yet.

Comments will not be approved to be posted if they are SPAM, abusive, off-topic, use profanity, contain a personal attack, or promote hate of any kind.

More »

Popular Apps

Uber Eats: Food DeliveryUber Technologies, Inc.

Remitly: Send Money & TransferRemitly

Watts ChapelThe Church Online

Tattoo Maker - Tattoo DesignWECHOICE MOBILE

Hero of Aethric | Classic RPGNorthern Forge

Talking Tom CatOutfit7 Limited

Gaia GPS: Offline Trail MapsOutside, Inc.

StreamTV by Buckeye BroadbandTiVo Platform Technologies LLC

Flyers & PostersDesygner Pty Ltd

Video Flyer Maker, TemplatesPhoto Studio & Picture Editor Lab

More »

Editor's Choice

Graham's RewardsRovertown

GrahamZain alabdeen albaghdadi

Glenn COEEdlio

CalliProDiwan Software Ltd

insert'25Pi.Art

Troy Martial ArtsFoxspin

GmailGoogle LLC

Shipt: Order Grocery DeliveryShipt

MAX/CORE RDMAGIC MAGNUM VENTURES

Regent Seven Seas CruisesNorwegian Cruise Line Holdings LTD